Americans’ Housing Optimism Gains More Momentum amid Reported Income Growth; Supports Forecast of Pickup in Housing Activity This Year.

Share of consumers saying “Good time to sell” reaches new survey high.

Katie Penote – 202-752-2261

WASHINGTON, DC Consumer attitudes about the housing market showed marked improvement last month, strengthening the case for a lift in housing activity this year, according to results from Fannie Mae’s May 2015 National Housing Survey. In line with the positive May jobs reportwhich showed an acceleration in average hourly earningsand reflecting recent trends of firming personal income growth, the share of survey respondents reporting a significant increase in their household income climbed 4 percentage points to a near all-time high. As job growth appears to be driving meaningful income growth, the outlook for housing market growth also is improving. Among those surveyed, the share who believe now is a good time to sell a home continued its steady climb, reaching an all-time survey high in Maysix percentage points higher than at the same time last year. Additionally, those saying they would prefer to buy rather than rent a home on their next move increased another three percentage points to 66 percent.

Things are looking up for housing, said Doug Duncan, senior vice president and chief economist at Fannie Mae. Those saying it is a good time to sell a house hit a survey high of 49 percent. Also, the percentage of consumers telling us their household income is significantly higher than 12 months ago grew six percentage points to 28 percent over the past two months. We have found that these two indicators good time to sell and income growth are key drivers for the performance of the housing market and play an important role in our soon to be released Home Purchase Sentiment Index (HPSI). The increase in these indicators suggests our forecast of moderate improvement in the housing market in 2015 is on course and mirrors the near-term performance of other leading market data, including mortgage applications and pending home sales.

SURVEY HIGHLIGHTS

Homeownership and Renting

- The average 12-month home price change expectation remained at 2.8 percent.

- The share of respondents who say home prices will go up in the next 12 months rose to 49 percent. The share who say home prices will go down fell to 6 percent.

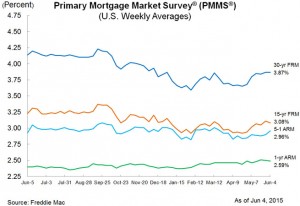

- The share of respondents who say mortgage rates will go up in the next 12 months fell to 47 percent.

- Those who say it is a good time to buy a house rose back up to 66 percent, while those who say it is a good time to sell went up 3 percentage points to 49 percent a new survey high.

- The average 12-month rental price change expectation rose to 4.3 percent.

- The percentage of respondents who expect home rental prices to go up rose to 55 percent.

- Those who think it would be easy to get a home mortgage decreased by 2 percentage points to 50 percent, while those who think it would be difficult remained at 46 percent.

- The share who say they would buy if they were going to move rose 3 percentage points to 66 percent, while the share who would rent fell to 27 percent.

The Economy and Household Finances

- The share of respondents who say the economy is on the right track decreased by 4 percentage points to 38 percent, while those who say the economy is on the wrong track rose by 3 percentage points to 52 percent.

- The percentage of respondents who expect their personal financial situation to get worse over the next 12 months rose to 12 percent.

- The share of respondents who say their household income is significantly higher than it was 12 months ago rose 4 percentage points to 28 percent.

- The percentage of respondents say their household expenses are significantly higher than they were 12 months ago increased to 31 percent.

The most detailed consumer attitudinal survey of its kind, Fannie Maes National Housing Survey polled 1,000 Americans via live telephone interview to assess their attitudes toward owning and renting a home, home and rental price changes, homeownership distress, the economy, household finances, and overall consumer confidence. Homeowners and renters are asked more than 100 questions used to track attitudinal shifts (findings are compared to the same survey conducted monthly beginning June 2010). To reflect the growing share of households with a cell phone but no landline, the National Housing Survey has increased its cell phone dialing rate to 60 percent as of October 2014. For more information, please see the Technical Notes. Fannie Mae conducts this survey and shares monthly and quarterly results so that we may help industry partners and market participants target our collective efforts to stabilize the housing market in the near-term, and provide support in the future.

For detailed findings from the May 2015 survey, as well as technical notes on survey methodology and questions asked of respondents associated with each monthly indicator, please visit the Fannie Mae Monthly National Housing Survey page on fanniemae.com. Also available on the site are in-depth topic analyses, which provide a detailed assessment of combined data results from three monthly studies. The May 2015 National Housing Survey was conducted between May 1, 2015 and May 20, 2015. Most of the data collection occurred during the first two weeks of this period. Interviews were conducted by Penn Schoen Berland, in coordination with Fannie Mae.

To receive e-mail updates with other housing market research from Fannie Mae’s Economic & Strategic Research Group, please click here.

Fannie Mae enables people to buy, refinance, or rent homes.

Visit us at: http://www.fanniemae.com/progress.

Follow us on Twitter: http://twitter.com/FannieMae.

Preferred Te Orienta – FHA-203K: el préstamo perfecto para comprar y rehabilitar la propiedad

Aunque el mercado de financiamiento hipotecaria ofrece una variedad de alternativas de préstamos hipotecarios, ninguno contiene en sus regulaciones una sección específica con el propósito de comprar una propiedad y poder rehabilitarla, todo con el mismo préstamo, como la sección 203k de los prestamos asegurados por FHA (Federal Housing Administration).

¿QUÉ ES EL PRÉSTAMO FHA-203k?

Es un préstamo federal asegurado por FHA con el que puedes reparar, mejorar, alterar y hasta reconstruir la casa desde sus cimientos, todo con el mismo préstamo. Su propósito fundamental son dos:

– Que la persona se sienta motivada a comprar la propiedad a pesar de la condición en que se encuentre la estructura, pues este financiamiento le suple los recursos económicos para restaurarla.

– Estimular la economía mediante la compraventa de propiedades a la vez que se rehabilitan las estructuras en los mercados o vecindarios.

¿CUÁLES PROPIEDADES Y REPARACIONES CUALIFICAN?

Toda propiedad existente de una hasta cuatro unidades de vivienda, en zonificación residencial. Algunas de las mejoras y/o reparaciones son: reparaciones que afecten la solidez, seguridad y salubridad; cambios en la estructura (añadir o reducir áreas), remodelar o reparar (baños y cocinas), convertir la propiedad a una accesible a personas con impedimentos, reemplazar o reacondicionar sistemas (electricidad, plomería, pozo séptico), reparación y/o tratamiento de techo y grietas, pisos y lozas, pintura exterior e interior, reparación de piscina ($1,500 máximo), entre otras.

Las mejoras que no son permitidas son: barbacoas, gazebos, sauna, spa, piscina (nueva), cancha para deportes, antena parabólica o de disco, entre otros.

Entre las ventajas del préstamo FHA-203k se encuentran;

¿QUIÉN PUEDE CUALIFICAR?

Los requisitos de cualificación son los mismos que para el préstamo FHA regular, como:

Para más información, llame a Preferred Mortgage al 787-903-0103 y sus originadores hipotecarios, licenciados por el Nationwide Mortgage Licencing System y la Oficina del Comisionado de Instituciones Financiera, le orientará.