MCLEAN, Va., Dec. 27, 2012 /PRNewswire/ — Freddie Mac (OTC: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the average fixed mortgage rates finishing the year near record lows, helping to keep homebuyer affordability high. The 30-year fixed eased slightly this week to average 3.35 percent, while the 15-year fixed remained unchanged at 2.65 percent.

MCLEAN, Va., Dec. 27, 2012 /PRNewswire/ — Freddie Mac (OTC: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the average fixed mortgage rates finishing the year near record lows, helping to keep homebuyer affordability high. The 30-year fixed eased slightly this week to average 3.35 percent, while the 15-year fixed remained unchanged at 2.65 percent.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 3.35 percent with an average 0.7 point for the week ending December 27, 2012, down from last week when it averaged 3.37 percent. Last year at this time, the 30-year FRM averaged 3.95 percent.

- 15-year FRM this week averaged 2.65 percent with an average 0.7 point, unchanged from last week when it averaged 2.65 percent. A year ago at this time, the 15-year FRM averaged 3.24 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.70 percent this week with an average 0.7 point, down from last week when it averaged 2.71 percent. A year ago, the 5-year ARM averaged 2.88 percent.

- 1-year Treasury-indexed ARM averaged 2.56 percent this week with an average 0.5 point, up from last week when it averaged 2.52. At this time last year, the 1-year ARM averaged 2.78 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following links for Regional and National Mortgage Rate Details and Definitions. Borrowers may still pay closing costs which are not included in the survey.

Quotes

Attributed to Frank Nothaft, vice president and chief economist, Freddie Mac.

“Mortgage rates ended this year near record lows. The 30-year fixed-rate mortgage averaged 3.66 percent for 2012, the lowest annual average in at least 65 years. Rates on 30-year fixed mortgages were nearly 0.6 percentage points below that of the beginning of the year, which translates into an interest payment savings of nearly $98,600 over the life of a $200,000 loan. Moreover, opting for a 15-year fixed mortgage at today’s rates, a homeowner could save an additional $138,400 in interest payments.”

Get the latest information from Freddie Mac’s Office of the Chief Economist on Twitter: @FreddieMac

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation’s residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for one in four homebuyers and is one of the largest sources of financing for multifamily housing. www.FreddieMac.com.

SOURCE Freddie Mac

For further information: MEDIA, Ruth Fisher, +1-703-903-3974, [email protected]

Capital Markets Remain Healthy

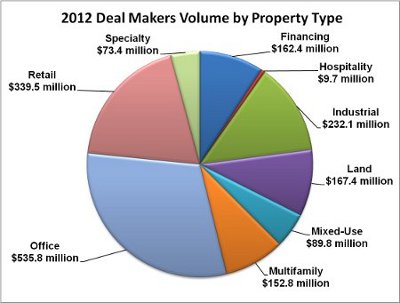

Commercial real estate capital markets remain stable despite rising uncertainty about the looming fiscal cliff, according to a recent Marcus & Millichap report. CMBS issuance volume this year is expected to top 2011s by more than $17 billion, but is not expected to return to a healthy level until 2013.

Overall lending volume rose 25 percent between 2Q11 and 2Q12, according to the report. Loans for retail properties increased 56 percent, lending in the hospitality and multifamily sectors rose 22 percent and 19 percent respectively, and office lending increased 15 percent. The industrial sector saw the only lending decline in this cycle, falling 5 percent.

Other highlights in the report include: